north carolina estate tax return

In fact the IRS does not have an inheritance tax while some states do have one. Taxpayers who filed before the Jan.

Web Up to 25 cash back Update.

. 2021 D-407 Web-Fill Versionpdf. 11 opening for Corporate returns and Feb. Web North Carolina has no inheritance tax or gift tax.

Owner or Beneficiarys Share of NC. E-File is available for North Carolina. And lastly doing the tax returns of the deceased and.

Some estates are administered by full administration. Web Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return. Web North carolina repealed its gift tax but you may still owe gift taxes at the federal level.

The information included on this website is to be used only as a guide in the preparation of a North Carolina individual income tax return. Effective January 1 2013 the North Carolina legislature repealed the states estate tax. Allocation of Income Attributable.

If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498. Web Services Available. Web Beneficiarys Share of North Carolina Income Adjustments and Credits.

Web Tax Bulletins Directives Important Notices. Complete this version using your computer to enter the. Web 2021 D-407 Estates and Trusts Income Tax Return.

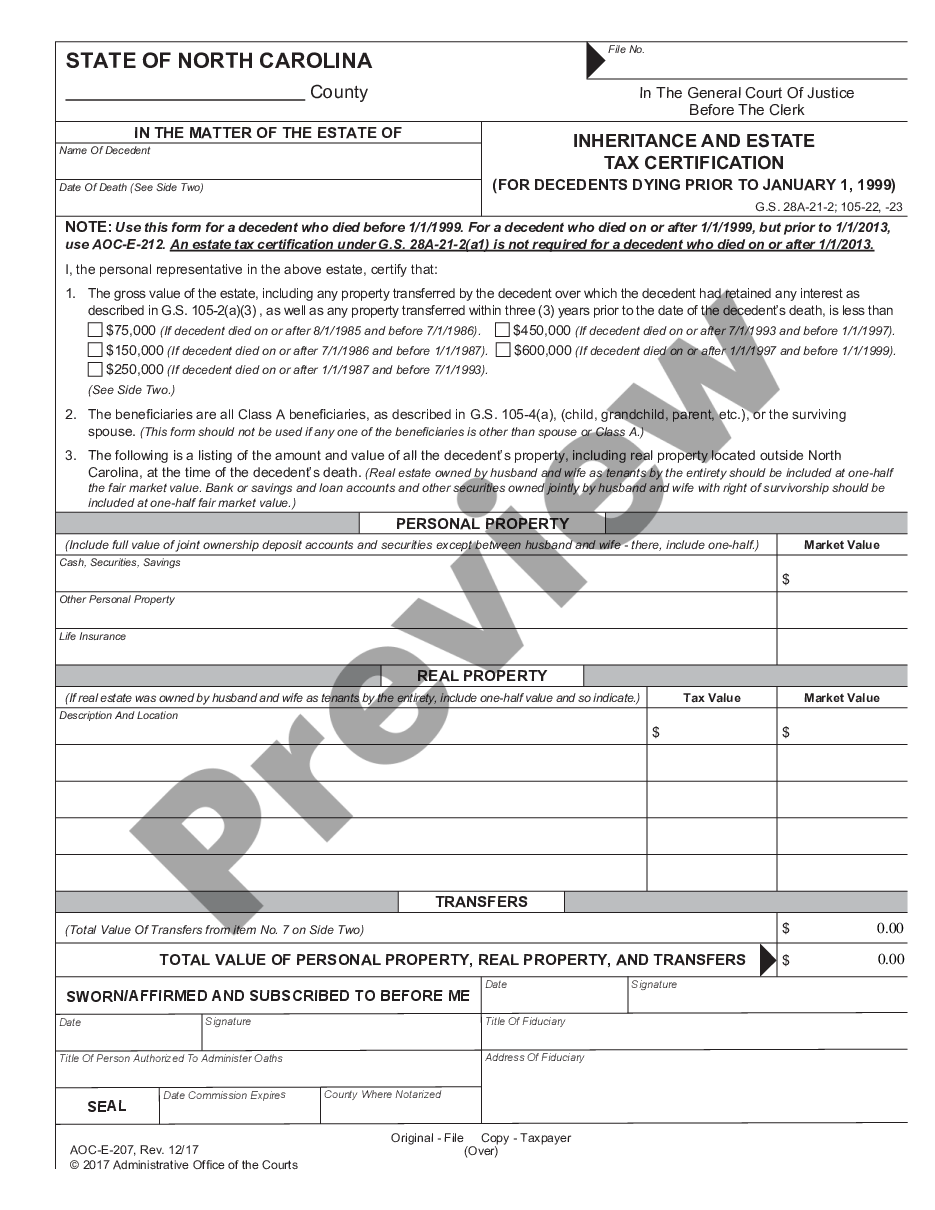

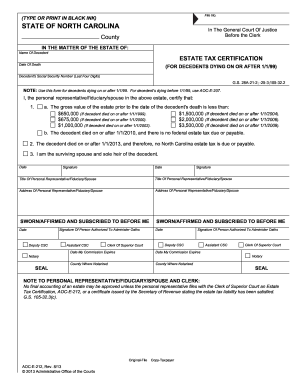

Web North Carolina Estate Tax Return - 2000. Individual income tax refund inquiries. Preparation of a state tax return for North Carolina is available for 2995.

So if you live in N. 105-1535a2 allows a taxpayer in calculating North Carolina. Your average tax rate is 1198 and.

2022 north carolina association of certified public accountants. The federal gift tax has an annual. Previous to 2013 if a North Carolina resident died.

Web In North Carolina this document is often combined with a Living Will to answer questions regarding end of life decisions. Web North Carolina Income Tax Calculator 2021. 1999 Form A-101 North Carolina Estate Tax return Use this form only if death occurred on or after January 1 1999 Files.

The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and. Web Individual Income Tax. Web The exemption amounts match those allowable on the Federal estate tax return - 5000000 in 2011 and 5120000 in 2012 - before the North Carolina estate.

Web North Carolina Department of Revenue. Web Estate administration is a process for handling a persons assets and debts after that persons death. Web It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act.

PO Box 25000 Raleigh NC 27640-0640. Web The agency began accepting Estate Trust tax returns on Feb. NC K-1 Supplemental Schedule.

North Carolina Estate Tax Everything You Need To Know Smartasset

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Income Tax Calculator Smartasset

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Tax Administration Duplin County Nc Duplin County Nc

Aoc E 307 Form Fill Out And Sign Printable Pdf Template Signnow

10 Ways To Reduce Estate Taxes Findlaw

Free North Carolina Last Will And Testament Template Pdf Word Eforms

How To Obtain A Tax Id Number For An Estate With Pictures

Form A 101 Estate Tax Return Web Fill In

North Carolina Estate Tax Our Top Strategies Irs Pitfalls

Guilford County Tax Department Guilford County Nc

North Carolina Estate Tax Everything You Need To Know Smartasset

State Estate And Inheritance Taxes Itep

Transfer On Death Tax Implications Findlaw

North Carolina Lgbt Legal Guide Page Esq Lorin G 9781975893439 Amazon Com Books